In the first quarter, Canadian businesses encountered ongoing subdued demand, yet emerging signs of renewed optimism are evident, as many anticipate a decrease in interest rates over the next year, according to the latest business outlook survey by the Bank of Canada.

The survey, released Monday, reveals a shift in various business indicators such as sales outlooks and employment intentions, which have reversed their downward trends witnessed over multiple quarters. Expectations for enhanced sales are not solely reliant on anticipated interest rate reductions but are also buoyed by population growth and endeavors to penetrate new markets or innovate products.

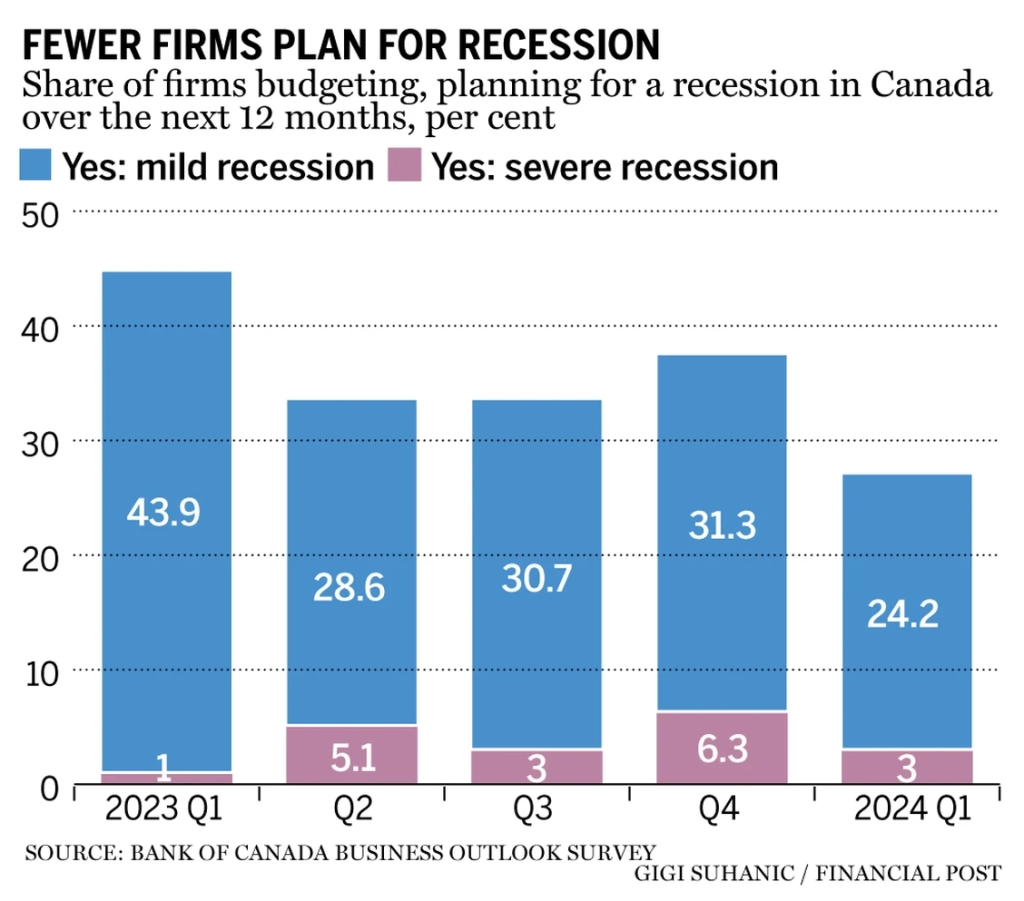

This upswing in sentiment, with businesses reporting slight improvements in conditions during the first quarter, contrasts a nearly two-year period of decline. Moreover, this improvement is widespread across regions, sectors, and business sizes. Additionally, fewer businesses are bracing for a recession in Canada over the next year compared to the previous survey conducted at the close of 2023.

About half of the businesses foreseeing improved sales growth in the coming year attribute it to expected declines in interest rates. Moreover, there’s a notable decrease in the proportion of firms expecting significant increases in costs and selling prices, compared to their peaks in 2022. Businesses are now planning for smaller price hikes compared to the previous 12 months.

Although the number of businesses planning substantial or frequent price increases is on a decline, a minority still cite factors hindering a return to normal pricing behavior. These factors include higher-than-pre-pandemic wage growth, yet-to-fully-recover profit margins, and incomplete transfer of higher costs from previous years.

While wage growth remains elevated compared to pre-pandemic levels, businesses in the latest survey indicate a relatively easier time filling job vacancies. Most anticipate a slowdown in wage growth as earnings align with the rising cost of living.

Approximately 40% of businesses report that their wage increases are no longer exceptionally high, akin to the proportion in the previous quarter of 2023. However, the share of businesses expecting prolonged high wage growth until 2025 has risen to 23%, up from 14% in the previous quarter.

According to the report, businesses’ pricing behavior is gradually returning to normalcy, although sluggish moderation in wage growth and gradual absorption of high costs continue to keep output price growth elevated.

Nonetheless, the latest survey indicates a decline in inflation expectations among businesses, with 27% expecting inflation to remain above two percent beyond three years, compared to 37% in the fourth-quarter 2023 survey.

Many businesses have tempered investment plans in response to high borrowing costs and persistently tepid demand. They are prioritizing investment efforts towards maintaining existing capacity rather than embarking on new projects for productivity enhancement or output expansion, citing long-term impacts of past interest rate hikes on completed projects financed at lower rates.