Economists see home sales falling another 10% to 15% and prices another 10%

Economists cautioned this week that the Canadian housing market is in a “recessionary” zone and that things will worsen before they get better.

Home sales have dropped by 45% since they peaked at 64,000 units in early 2021, according to the housing market prediction from Canadian Imperial Bank of Canada. That is 12% less than their 10-year average prior to the epidemic.

With per capita sales at levels not seen since the 2008 recession, the situation appears even more dire when seen by the general public.

According to CIBC economists Benjamin Tal and Katherine Judge, “the Canadian housing market is in recessionary territory, as it faces its most significant test since the 1991 recession.”

“And activity will deteriorate further into the first half of 2024 as interest rates remain elevated, and supply floods the market.”

Prices have not decreased as much as sales thus far. The benchmark home price is still 38% above pre-pandemic levels and has only decreased by 1% from its 2022 peak, according to the research.

A deficiency of fresh listings in the market has protected prices. Early 2022–2023 had a 31% decrease in new listings, which helped to slow the price drop by bringing fewer properties to the market.

But CIBC noted that is beginning to change. The number of new listings has increased recently, going up 31% from the March 2023 low.

“That spike partly stems from owners listing their properties because of financing problems as mortgage payments rise quickly,” the experts noted.

According to them, Toronto has already entered a buyers’ market due to an increase in listings and a decrease in sales nationwide. However, since rising mortgage rates are keeping expenses high, this is unlikely to tempt purchasers to come off the sidelines.

According to Tal and Judge, “housing market activity will continue to deteriorate with listings on an upward trajectory, demand from strong population growth, and a relatively tight labour market eroded by high interest rates.”

According to CIBC, home sales could drop another 10% to 15% by the end of the first quarter of 2024 and most likely won’t rebound to pre-pandemic levels until early to mid-2025.

The prediction from CIBC coincides with forecasts from Toronto-Dominion Bank economists that house values will decline by twice as much as previously anticipated.

According to Bloomberg, TD raised its prediction of a 5% reduction in average pricing through the first quarter of 2024 to a 10% decline on November 22.

According to TD, rising bond yields will drive up fixed-mortgage rates, which will drive more buyers out of the market. The buyers who stay will be in a better position to negotiate cheaper costs.

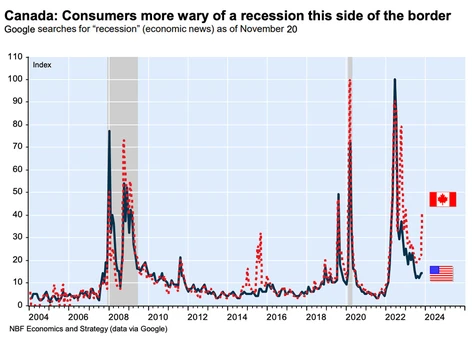

Canadians seem to be thinking about the recession a lot more than their American neighbours.

According to today’s National Bank of Canada chart, there was a significant increase in the number of Canadians entering the term “recession” into online search engines in November. It makes sense that throughout the last six months, the nation’s GDP has stagnated and the jobless rate has increased by 0.7 percentage points. In contrast, the GDP of the US has increased to 4.9%.

Economists Alexandra Ducharme and Matthieu Arseneau of the National Bank stated, “While recent developments may not qualify as a recession, Canadians appear concerned about the situation currently prevailing in the country, especially given recent mass layoffs.”

But exercise caution while you search. “Economists noted that there is ample evidence demonstrating how a recession can be self-fulfilling, meaning that people who believe they are in one are more likely to experience one themselves and start modifying their behaviour accordingly.”

If you’re among the many people in Canada who file your taxes both as a resident of Canada and as a citizen of the United States, then welcome to a world of complicated filing requirements for U.S. tax purposes and, occasionally, additional taxes. You follow Kim Moody through it.